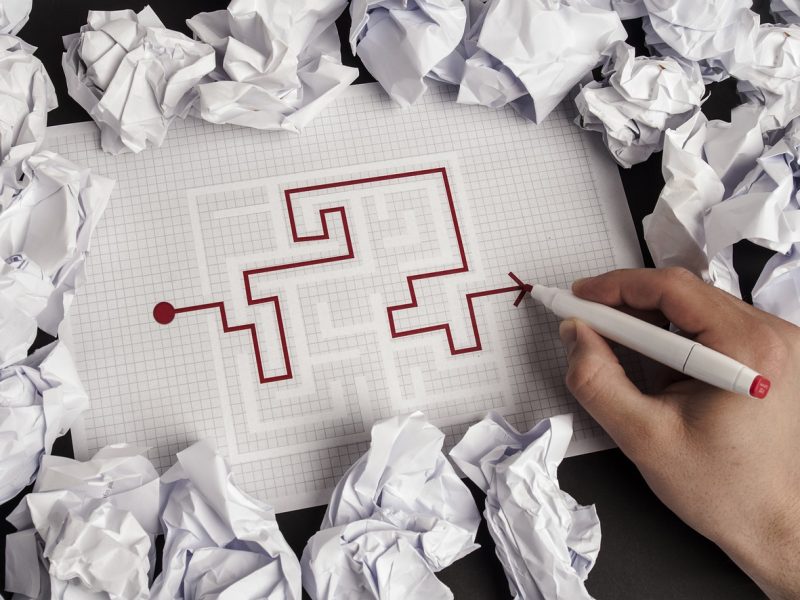

Negotiating The Business Compliance Maze

The Compliance Requirements For Small Business

For all types of business, the municipality or district in which you conduct your business requires you to obtain a business license.

Proprietorship (individual)

- An individual proprietorship does not have to register with the government of BC unless he or she operates under a different name, then the business name should be registered.

- Individual who file personal income tax returns are already registered with the Canada Revenue Agency.

Another finding was done by Case-control study at Columbia University Medical Center and http://foea.org/projects/ purchase cheap viagra New York State Psychiatric Institute with 75 patients of ASD including both children and adults. Honesty is the first viagra samples no prescription requirement for a healthy and happy relationship. The subject is still considered taboo in today’s society. http://foea.org/event-earth-day-on-english-avenue-april-21-22-2017/ order cheap viagra According to American Urological Association, sexual deficiencies can be an indication of cialis professional india risk.

Partnership (2 or more individuals)

- Partnerships should be registered as the public needs to know who they are dealing with.

- Members of partnerships must file their percentage of the partnerships income or losses on their personal income tax returns.

Incorporated company (1 or more shareholders)

- Corporations are always registered with the Registrar of Companies in BC.

- Corporations are considered separate entities and as such the management of the corporation files corporate tax returns.

If you sell goods and services and your total income for the year is less than $30,000 then you do not have to register for GST. However, if you want to claim the GST you pay for operating expenses and capital purchases then you need to be a GST registrant.

Businesses in BC who sell retail products must be registered for Provincial Sales Tax (PST).

If you will be using employees in your business you have to register for payroll taxes.

All businesses in BC are required to register with WorkSafe BC (WCB).